Estate planning is an important undertaking, especially for seniors on Cape Cod, Martha’s Vineyard, Nantucket, and Plymouth, as it enables them to organize their  financial and healthcare affairs properly and thoughtfully in preparation for the future. The process of estate planning ensures that your assets are distributed among beneficiaries according to your orders. It also ensures that there is a clear roadmap for your healthcare preferences and responsibilities after you’re gone. For seniors, estate planning holds particular significance due to the unique considerations that come with age, such as healthcare concerns and wealth preservation.

financial and healthcare affairs properly and thoughtfully in preparation for the future. The process of estate planning ensures that your assets are distributed among beneficiaries according to your orders. It also ensures that there is a clear roadmap for your healthcare preferences and responsibilities after you’re gone. For seniors, estate planning holds particular significance due to the unique considerations that come with age, such as healthcare concerns and wealth preservation.

“Don’t wait. The time will never be just right.”

— Napoleon Hill.

In this guide, we’ll highlight 12 crucial points that show just how important estate planning for seniors is. Each point serves as a building block toward creating a well-structured estate plan. From initiating the process early to navigating tax implications and regularly updating your plan, these steps are essential for seniors looking to safeguard their assets and ensure their wishes are conducted seamlessly.

1. Start Estate Planning Early

Beginning estate planning sooner rather than later allows seniors to carefully consider their wishes and make informed decisions. This early start ensures that their assets are managed and distributed according to their preferences and helps prevent complications that may arise if no plan is in place. Early planning also provides ample time to review and make necessary adjustments as circumstances change over time, resulting in a more comprehensive and well-thought-out estate plan.

2. Set Goals

Setting clear estate planning goals is crucial. Seniors should define their objectives, whether it’s ensuring financial security for their loved ones, supporting a charitable cause, or minimizing taxes. Establishing these goals helps seniors and their advisors design an estate plan that aligns with their wishes and priorities. These objectives function as a roadmap for making important decisions about asset distribution, healthcare choices, and financial matters.

3. Create a Will

Creating a legally valid will is the cornerstone of any estate planning. Having a will can help outline how your assets and possessions should be distributed as directed upon their passing. It’s essential to be specific and unambiguous in the will to prevent disputes among beneficiaries. The will also typically designates an executor responsible for overseeing the distribution process. Creating a well-crafted will ensures that a senior’s wishes are legally binding and helps streamline the probate process, making the transition of assets smoother for their heirs.

4. Choose an Executor

An executor is a crucial figure in your estate plan, responsible for conducting the directives outlined in your will. It’s vital to select someone you trust implicitly, as this individual will manage your affairs after you’re gone. Your executor should be organized, meticulous, and capable of handling financial matters. It’s good practice to discuss your choice with the person you plan to appoint as executor to ensure they’re willing to accept the responsibility. Be sure to name a contingent executor in case your primary choice is unable or unwilling to fulfill this role.

5. Power of Attorney

A power of attorney (POA) is a legal document that grants someone the authority to make financial decisions on your behalf if you become incapacitated. This individual, known as your attorney-in-fact or agent, should be someone you trust implicitly. You can designate a general POA to manage various financial matters or choose a limited POA for specific purposes. It’s essential to discuss your wishes with your chosen agent and ensure they fully understand your financial preferences and values.

6. Healthcare Proxy

A healthcare proxy, also known as a medical power of attorney, is a critical component of your estate plan. This document designates a trusted individual to make healthcare decisions on your behalf if you’re unable to do so. Your healthcare proxy should be someone who knows your medical preferences and is willing to advocate for your healthcare wishes. Discuss your medical preferences thoroughly with your healthcare proxy and provide them with a copy of your living will if you have one. This ensures that your medical treatment aligns with your values and preferences even when you can’t express them directly.

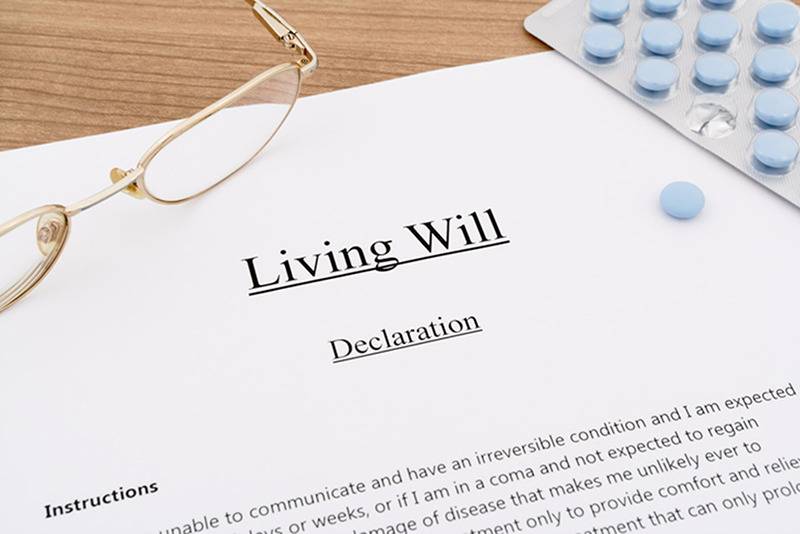

7. Living Will

A living will be a crucial part of estate planning, specifically addressing your medical care preferences. In this document, you detail the medical interventions you wish to receive or avoid if you become incapacitated and cannot communicate your desires. It provides healthcare providers and loved ones with clear guidance on issues like resuscitation, life support, and organ donation. Having a living will ensures that your end-of-life medical decisions align with your values and spares your family from making difficult choices during already emotional times.

8. Review Beneficiaries

Periodically reviewing and updating the beneficiaries on your retirement accounts and life insurance policies is essential. Life events such as marriage, divorce, births, and deaths can impact your intended beneficiaries. Ensuring that your beneficiaries are current helps avoid potential conflicts and ensures that your assets go to the right individuals or organizations as you intended.

9. Consider Trusts

Trusts can be valuable tools in estate planning. They allow you to transfer assets to a trustee, who manages and distributes them according to your instructions. Trusts can help you avoid the probate process, maintain privacy, and provide specific guidelines for asset distribution. They’re especially useful if you want to leave assets to minor children or individuals with special needs, as you can stipulate when and how the assets should be distributed to them. Trusts offer flexibility and control over your estate beyond what a will can provide.

“A good plan is like a road map: it shows the final destination and usually the best way to get there.” — H. Stanley Judd.

10. Minimize Taxes

Minimizing estate taxes is a crucial aspect of estate planning for seniors. One effective strategy is gifting assets during your lifetime, taking advantage of annual gift tax exclusions. Additionally, consider placing assets into trusts, such as irrevocable life insurance trusts or charitable remainder trusts, to reduce the taxable estate. Being mindful of the federal and state tax thresholds is essential to ensure that as much of your estate as possible goes to your beneficiaries rather than paying unnecessary taxes.

“What makes greatness is starting something that lives after you.” — Ralph W. Sockman.

11. Regular Updates

Estate planning isn’t a one-and-done process. Life circumstances change, such as marriages, divorces, births, and deaths, so it’s essential to regularly review your estate plan. Updates can include changing beneficiaries, updating your will or trust documents, or modifying your power of attorney and healthcare proxy selections. By keeping your estate plan current, you can ensure that it aligns with your current intentions, helping to avoid potential conflicts or issues down the road.

12. Consult Professionals

Consulting with professionals is a critical step in estate planning. An experienced attorney specializing in elder law and estate planning can help navigate complex legal requirements and ensure your documents are legally sound. Additionally, consider collaborating with a financial advisor to optimize your plan, especially regarding tax-efficient strategies. These professionals can provide valuable insights and ensure your estate plan aligns with your financial and legal goals.

“Always plan ahead. It wasn’t raining when Noah built the ark.” — Richard Cushing

Simply put, estate planning for seniors is not just a financial or legal matter; it’s a roadmap for securing your legacy and ensuring your wishes are honored. These 12 key points emphasize the importance of early planning, tax considerations, and regular updates. By proactively engaging in estate planning, seniors can provide invaluable peace of mind to themselves and their loved ones, knowing that their assets and healthcare decisions are well-prepared for the future.

Check Out the Top Estate Planning Professionals on Cape Cod and the Islands.

If you are a senior on Cape Cod, here are other activities on Cape Cod you may enjoy.